These fees are considered variable under Topic 606 since both types of fees are dependent on a variable base ie assets under management or performance during a defined period. ASC Payment Rates for 2020.

![]() Common Asc 606 Issues Asset Management Revenuehub

Common Asc 606 Issues Asset Management Revenuehub

Updates to ASC 350-40 From a customers perspective if a cloud computing agreement includes a license for the use of software the portion of the agreement for the software license and the related implementation fees are capitalizable.

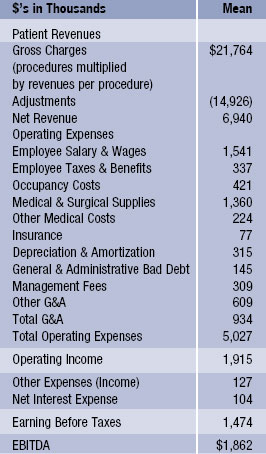

Asc management fees. In any other case 0025 of gross proceeds in AB. Some SaaS contracts require the customer to pay an upfront fee to set up the customer on the entitys systems and processes. 10 percent of management companies 3.

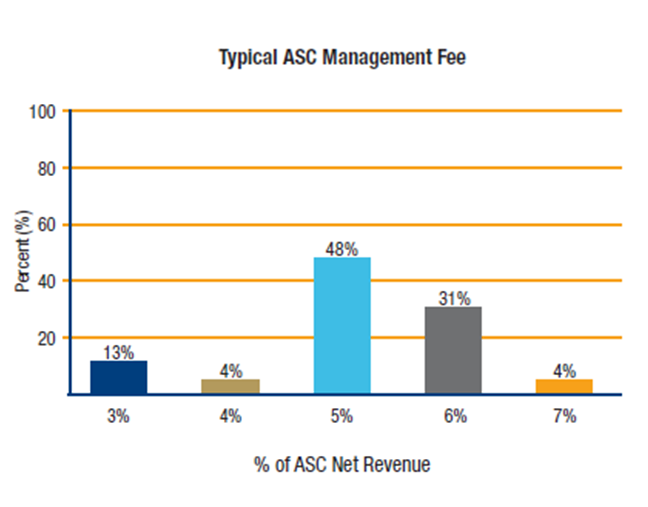

ASC The annual fee will be calculated as follows. ASC companies typically charge a management fee as a percentage of net revenue although the percentage varies by company. Simplify ASC is the comprehensive ASC management platform built with the insight you need to run a profitable center identify opportunities for growth.

Which Company is the Licensee. The company has been in the region for 5 years and built a strong reputation as a reliable and professional cost value and claims consultant and quantity surveyors. A complete and current Alberta fee schedule can be found in ASC Rule 13-501 Fees.

However for reporting issuer that is not an investment fund a filing fee of 200. Now ASC 350-40 has a consistent and clear approach that entities can apply to account for hosting agreement fees. An investment fund must file a completed Form 13-501F5 Investment Fund Participation Fee and pay a flat fee of 350 per fund.

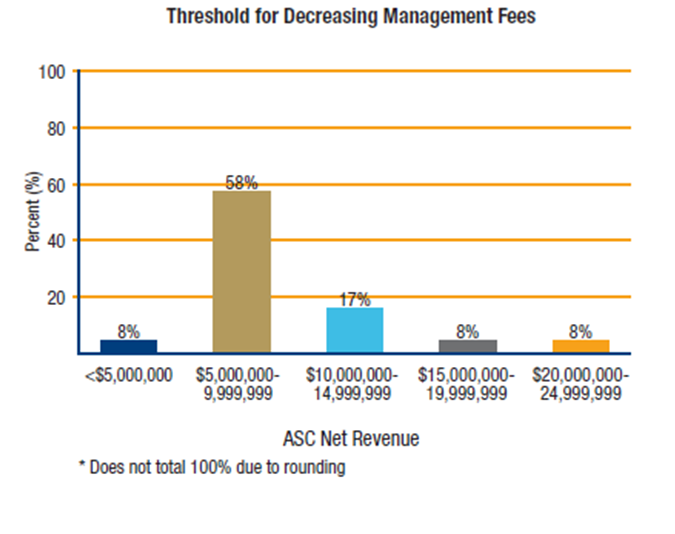

The ASC would instead include the cost of the device in the procedure code and submit one line item. The customer can renew the contract each year without paying an additional fee. Percentage that have a minimum annual management fee.

Search for a State or Area. Who Are ACS Cost and Value Management Consultants. Here are five things to know about ASC management fees according to HealthCare Appraisers 2010 ASC Valuation Survey which includes responses from 17 organizations representing over 500 surgery centers throughout the country.

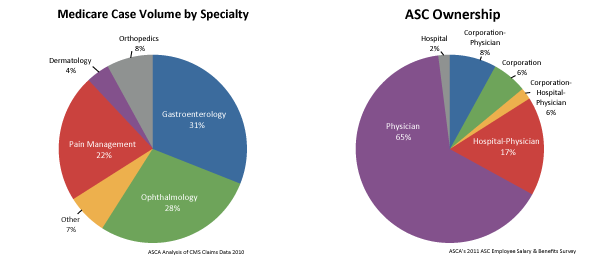

Annual fee Royalties you are using the ASC logo on consumer facing products wholesale value of your seafood sales with the ASC logo. For fees related to applications to the ASC please see ASC Policy 12-601 Appendix 1. Average ASC Management Fees Paid as a Percent of Net Revenue 3 percent of net revenue 0 percent 4 percent of net revenue 0 percent 5 percent of net revenue 6 percent 6 percent of net revenue 55 percent 7 percent of net revenue 22 percent Other 17 percent.

No proceeds fee applies for this issuer type. See the Urban AreaState Code and be sure to select the appropriate CBSA to view fees for your facility. The survey was.

Another 24 percent take 5 percent of net revenue. Management fees Asset managers are typically paid for their services through a combination of a base management fee and an incentive or performance fee. Most respondents 43 percent say they charge a minimum of five percent of net revenue as their management fee.

Typical ASC management fee rate as a percentage of net revenue 1. The agreement to waive or reimburse these fees can be entered into either 1 in conjunction with the. ASC management fees as a percentage of net revenue.

ASCs are not allowed to base price on the allowable code from the Medicare Physician Fee Schedule MPFS. The fee is a nominal amount and is nonrefundable. Here are 10 statistics about management fees charged to ambulatory surgery centers by management companies according to data from HealthCare Appraisers 2010 ASC Valuation Survey.

Calculate the regulatory and late fees for Form 45-106F1 Report of Exempt Distribution filings in Alberta using our online fee calculator. Typical minimum annual management fee charged. Here are 24 statistics on ASC management company fees from the HealthCare Appraisers 2017 ASC Valuation Survey.

Set-up fees are common in SaaS arrangements. A consumer facing product is defined as a -labelled sales GBP of consumer facing products. Collected once see policy document.

Forty-three percent of companies take 6 percent of the ASCs net revenue as the management fee. 10 percent of management companies 2. View the ASC procedures and payment amounts grouped by the Core-Based Statistical Area CBSA code.

The ASC will get paid for the device but does not submit a separate line item for the device. 24 percent of management companies 4. Asset managers sometimes waive their management fee or reimburse a fund for expenses incurred beyond an agreed upon threshold.

20 percent take 3 to 4 percent of net revenue. In the case of mutual fund 002 of gross proceeds in AB or. ACS Cost and Value Management Consultants has been formed by the Senior Management team of Aspect Alliance Commercial Services FZ LLC.

In the case of money market fund 002 of net proceeds in AB or. A Class 3A reporting issuer must file a completed Form 13-501F4 Class 3A Reporting Issuers Participation Fee and pay a flat fee of 400.

Establishing An Ambulatory Surgery Center A Primer From A To Z Part 1

Establishing An Ambulatory Surgery Center A Primer From A To Z Part 1

Healthcare Appraisers 2014 Asc Valuation Survey Statistics On Valuation Multiples Management Fees

Healthcare Appraisers 2014 Asc Valuation Survey Statistics On Valuation Multiples Management Fees

8 Asc Management Tips That Deliver Results

8 Asc Management Tips That Deliver Results

Management Of Women With Asc Us Cytology And Positive Hr Hpv And L Sil Download Scientific Diagram

Management Of Women With Asc Us Cytology And Positive Hr Hpv And L Sil Download Scientific Diagram

Asc 606 Updates What Asset Management Entities Should Know Bkd Llp

Asc 606 Updates What Asset Management Entities Should Know Bkd Llp

Asc Solutions Management Services

Asc Solutions Management Services

Healthcare Appraisers 2014 Asc Valuation Survey Statistics On Valuation Multiples Management Fees

Healthcare Appraisers 2014 Asc Valuation Survey Statistics On Valuation Multiples Management Fees

Asc Billing Services Ambulatory Surgery Center Rcm

Asc Billing Services Ambulatory Surgery Center Rcm

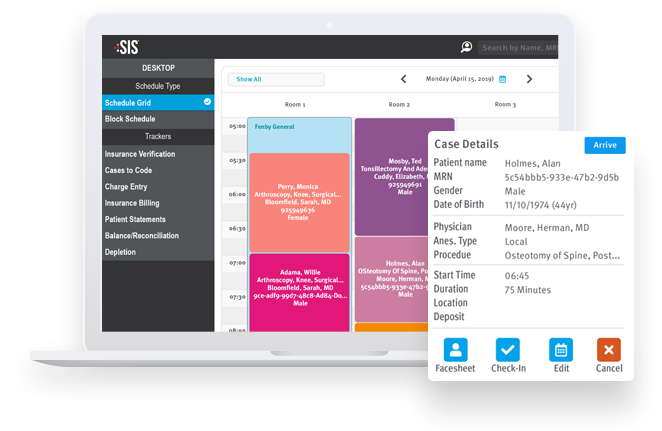

Sis Office Asc Management Software Sis

Sis Office Asc Management Software Sis

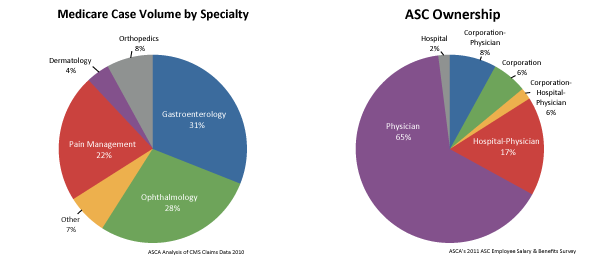

Ascs A Positive Trend In Health Care Advancing Surgical Care

Ascs A Positive Trend In Health Care Advancing Surgical Care

Steps To Establish An Ambulatory Surgery Center Practice Partners

Steps To Establish An Ambulatory Surgery Center Practice Partners

Developing Managing Ambulatory Surgery Centers Ambulatory Surgery Center Association Asca

Developing Managing Ambulatory Surgery Centers Ambulatory Surgery Center Association Asca

Endoeconomics Spring Summer 2017 By Pe Gi Solutions Issuu

Endoeconomics Spring Summer 2017 By Pe Gi Solutions Issuu

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.