While persons residing in nursing homes paid for by Medicaid are permitted to have monthly incomes as high as 2382 in 2021 in most states those individuals are not permitted to keep that income. Dental and vision care.

They have reviewed their medical expenses and decided that the 12-month period ending in 2020 they will use to calculate their claim is July 1 2019 to June 30 2020.

Medical 2020 income. In this case youd get a bigger tax break by itemizing your deductions than by taking the standard deduction even if youre 65 or older. In 2019 the IRS allowed you to deduct medical expenses that exceeded 75 of your adjusted gross income. To illustrate how the 75 threshold works.

You qualify for ABD-MN Medi-Cal. Or for a dependant who is a member or a dependant of a member of a medical scheme or fund where the taxpayer him- or herself is not a member of a medical scheme or fund. These out-of-pocket premiums should be deducted on line 3 of the Unreimbursed Health Care Expenses Worksheet.

2102020 Adults ages 19 64. For the current tax year you have had 5475 of qualifying medical expenses. You were 18 years of age or older at the end of 2020.

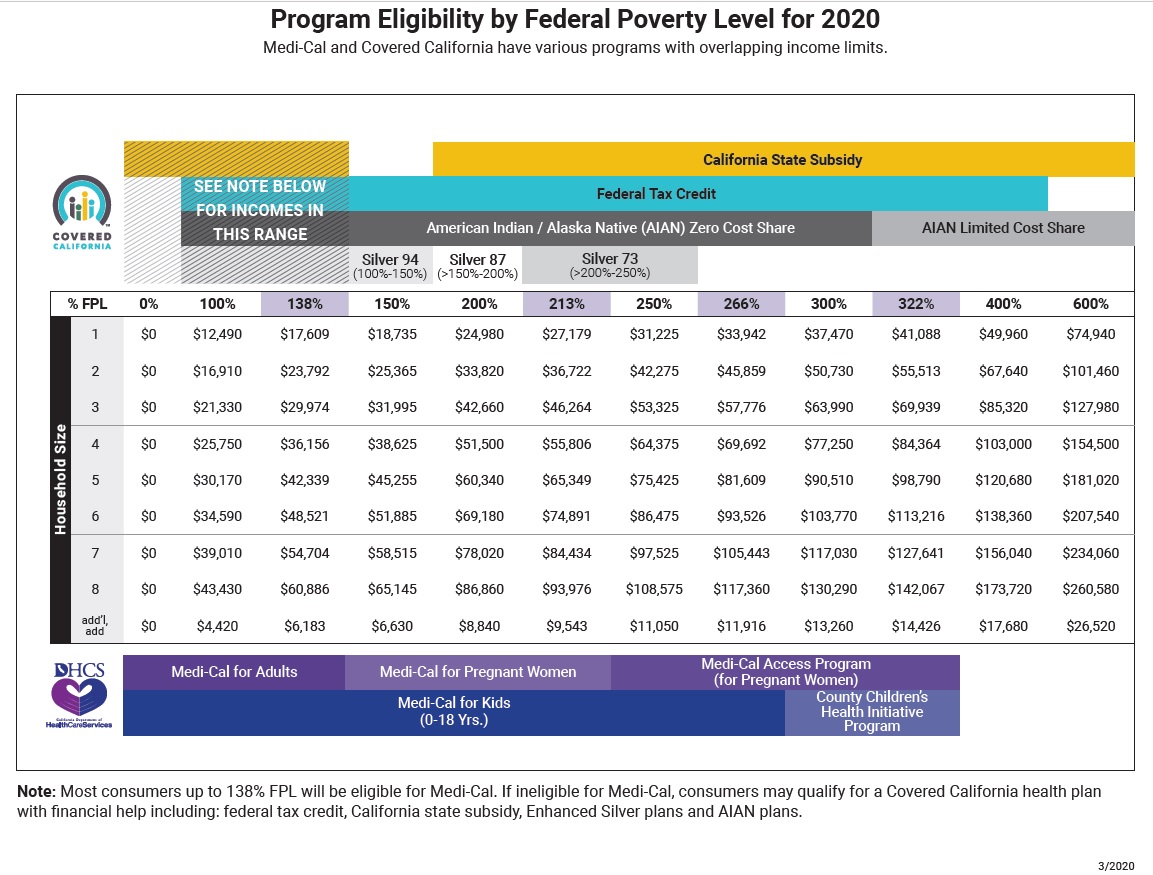

Travel expenses for medical care. Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income. In most cases their income.

The calculation is the same regardless of your adjusted gross income. 1 2019 all taxpayers may deduct only the amount of the total unreimbursed allowable medical care expenses for the year that exceeds 10 of their adjusted gross income. The 100 column display 2020 FPL values as published by the Department of Health and Human Services.

Psychologists and psychiatrists visits. You were resident in Canada throughout 2020. In 2020 the IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed 75 of their adjusted gross income if the taxpayer uses IRS Schedule A to itemize their deductions.

Income guidelinesrnfinancial helprnMNsure overview Created Date. You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. Qualified IRS Medical Deductions.

2020 income guidelines for Ohio Medicaid For familieshouseholds with more than 8 persons add 4480 for each additional person. To see if you qualify based on income look at the chart below. R332 per month for the taxpayer who paid the medical scheme contributions.

Rob their 19-year-old son 1000. 2020 Income Guidelines and MNsure Overview Author. You have to reduce your medical expenses by 75 percent of your AGI.

Jen their 16-year-old daughter 1800. This will tell you how much can be deducted. Generally out-of-pocket medical insurance premiums paid by the taxpayer during the part of the year the taxpayer was eligible are deductible to the extent they exceed 75 of the taxpayers federal adjusted gross income.

They had the following expenses. 2020 income guidelines for financial assistance and MNsure overview Keywords. For example if your AGI is 50000 the first 3750 of qualified expenses 75 of 50000 dont count.

20192020 year of assessment. You will have to pay the first 981 in medical expenses during the month before Medi-Cal. Income levels reflect the 1 conversion to MAGI eligibility and 2 addition of the 5 percentage point disregard.

How to Deduct Medical Expenses For Tax Purposes. If your adjusted gross income for 2019 was 50000 only medical expenses that exceed 3750 would qualify for the deduction. Income numbers are based on your annual or yearly earnings.

Your remaining medical expenses are 28500 31500 minus 3000. The way to do it is to multiply your adjusted gross income by 0075. Your share of cost is 1581 your countable income - 600 the Maintenance Needs Level for an individual living alone 981.

The deduction value for medical expenses varies because the amount changes based on your income. You must also meet the criteria related to income. In this case you can now deduct 2100 in medical expenses from your tax return.

Your countable income is too high for free Medi-Cal and you dont work so you cant get Medi-Cals Working Disabled Program. Total medical expenses 5300. Prescription medications and appliances.

Instead all of their income except for a personal needs allowance which ranges for 30 150 month must go towards paying for their cost of care. In addition in 2020 you can only deduct unreimbursed medical expenses that exceed 75 of your adjusted gross income AGI found on line 11 of your 2020 Form 1040. Those who are over the age of 65 can deduct qualified medical expenses that exceed 75 of their AGI.

75 percent of 40000 is 3000.