So-called surprise billing comes about when patients visit a hospital or emergency room thats part of their insurance companys network but then they receive care from a. Its estimated that as many as 80 percent of hospital bills contain errors.

An Examination Of Surprise Medical Bills And Proposals To Protect Consumers From Them Kff

An Examination Of Surprise Medical Bills And Proposals To Protect Consumers From Them Kff

About 1 in 7 hospital patients get a surprise bill a charge for an out-of-network procedure or health care provider even when they were admitted to a hospital in their insurers network.

Surprise hospital bills. Why do surprise bills happen. Check Your Itemized Bill for Mistakes. Surprise billing happens when someone goes to a hospital covered by their insurance network only to be hit with unforeseeable bills because the doctor or specialist who treated them is out of network.

In many instances this can be the result of clerical errors fraudulent practices or procedures that were either not authorized or performed by providers who were not within your insurance companys network. Hospital billing departments handle a lot of data. The dollars racked up while many patients were unconscious and an out-of-network specialist simply walked.

At the hospital theyre handed a stack of paperwork to sign authorizing treatment. Review the bill carefully and check for mistakes. In many corners of the country surprise hospital bills are an all-too-common practice.

Naturally they sign this because you know its an emergency. A patient has an emergency situation and heads to their local hospital. Heres what you need to know.

Even if the hospital is in your insurers network it is possible. Joey has filed a bill mandating rules against surprise medical billing or patients receiving unexpected bills at inflated prices and opaqueness in the prices of medical services. Balance billing better known as surprise billing happens when a patient receives care from a doctor or hospital outside of her insurers network.

Most surprise medical bills are the result of being treated by someone outside your insurance companys network of providers. Communicate and negotiate. 5 Ways To Handle A Surprise Medical Bill 1.

A recent Kaiser study found that nearly equal numbers of insured and uninsured people complained that health-care bills were taking a bite out of their financial health. Thats when things can go off the rails. It might sound crazy but unless youre unconscious you should inquire as to whether your services will be covered by your health insurance prior to receiving medical attention at a hospital.

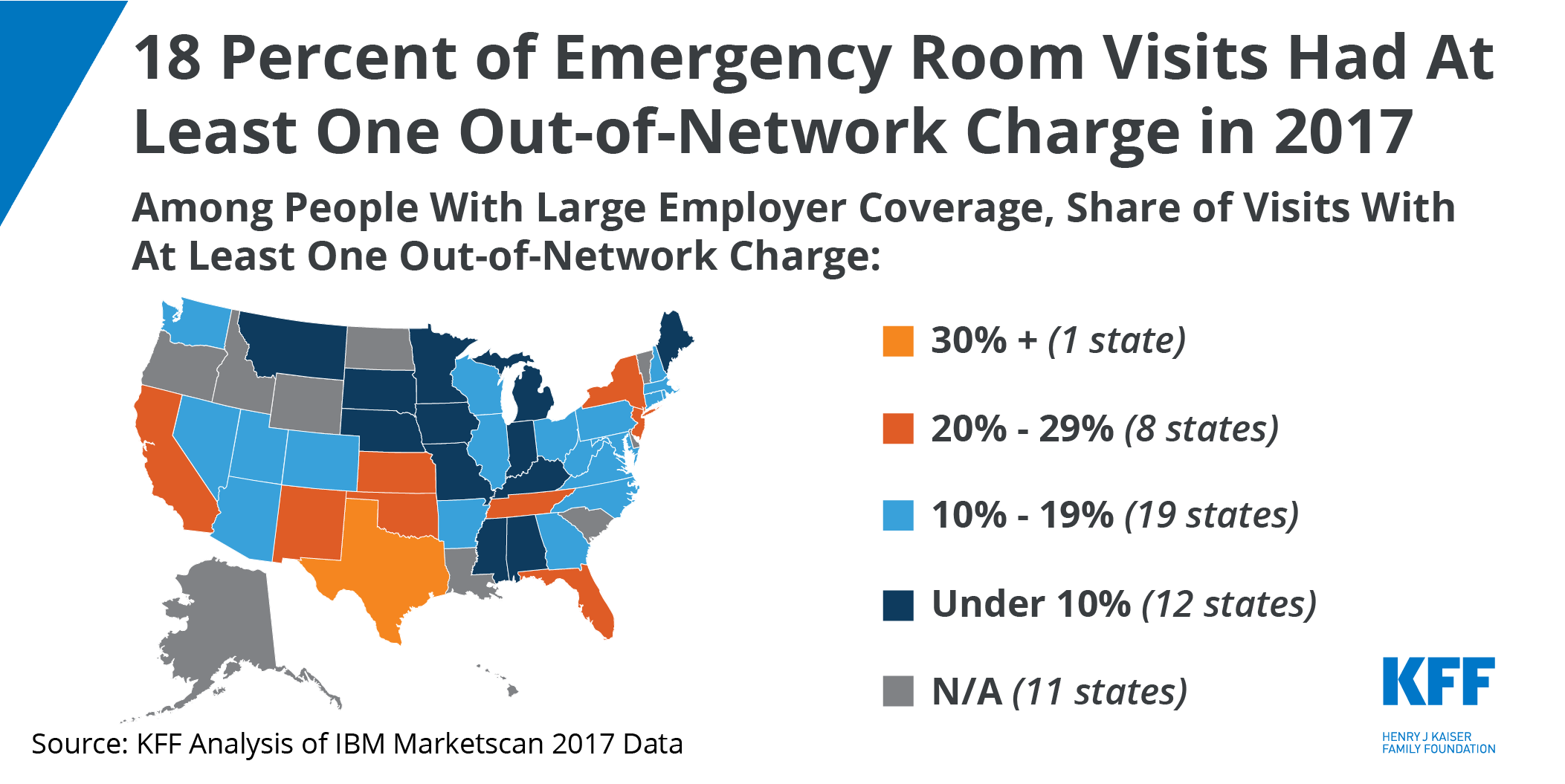

The likelihood of being charged with a surprise bill varies by state and medical specialty but Florida had the highest share of in-network hospital admissions. Learn about balance billing and whether it affects you. Subsequently the doctor or hospital bills the.

Thus a bill received by a patient for services rendered by a non-participating physician in a participating hospital or ambulatory surgical center when a participating physician is unavailable or a non-participating physician renders services without the patients knowledge or when unforeseen medical services arise may be a surprise bill under Financial Services Law. What if you receive a hefty bill from a doctor you dont. Excessive or surprise hospital bills can arise whether you are self-pay or have insurance.

Heres how it works. Despite your best efforts you might still receive a surprise bill for COVID testing or treatment. Having a surprise out-of-network bill raised the total bill by an average of 14083.

Unfortunately surprise hospital bills have become as American as apple pie as healthcare becomes increasingly unaffordable. Dont panic you still have options. What You Can Do About Surprise Coronavirus Hospital Bills.

So you want to avoid those out-of-network providers whenever you can. Health-care bills have a major impact on American families even those who have health insurance.