For the CEO vs. The chart below compares the cumulative increases in CEO pay and US.

Executive Compensation 2020 The Most Important Thing Private Companies Should Do Now

Executive Compensation 2020 The Most Important Thing Private Companies Should Do Now

CEO pay in the US.

Ceo compensation as percentage of revenue. At median CEO pay was 40x the GC. The increase in Invesco CEO Mark Flanagans pay as a percentage of net income is a bit deceiving. Executives know that a raise in their own salary of say 10000 will mean 50000 in raises across all other positions.

Median CEO compensation is 46 percent of revenue. Annually may look to setting a salary at 10 of their budget while the larger organizations in the tens of millions of dollars in revenue annually may set a salary at 1-25 of the budget. Data skewed by large number of smaller groups where pay is proportionally greater.

Most funded pre-revenue companies pay their CEOs a salary. We found executives paid up to 88 of total revenue and 583 of all salaries and benefits paid. If any of that bonus say 500000 does not vary with performance then the CEOs salary is really 15 million.

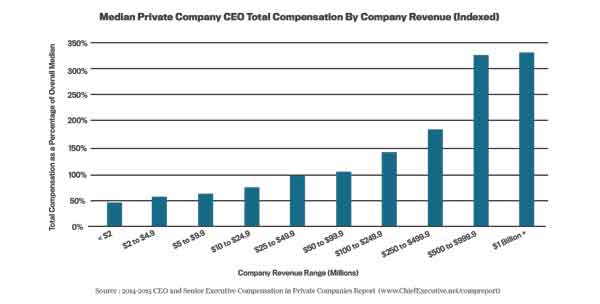

Correlation Between CEO Compensation and Profitability Controlling For Company Size Total CEO Compensation by Industry Median. Total CEO Compensation by Company Revenue 75th Percentile. Executive pay increases have slowed for a couple of reasons.

Top 10 highest-paid nonprofit CEOs. 60000 more to raise next year. Investor and other stakeholder scrutiny and the tax reform put in.

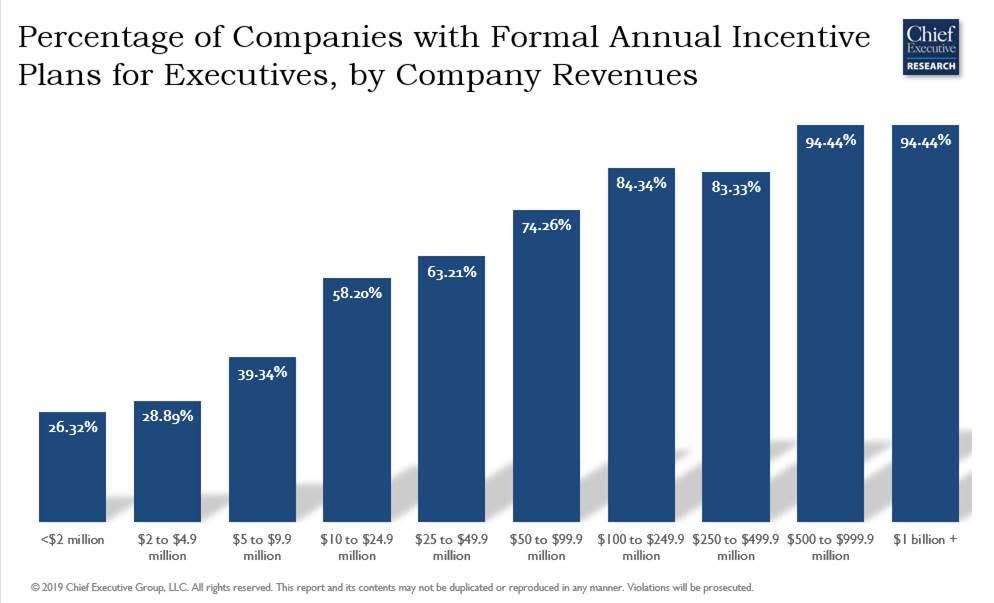

This contrasts with the rates of 124 and 91 for the year prior see Figure 17. Value of CEO Ownership of Company Equity by Company Revenue Top Quartile. CEO Compensation Also Varies by Ownership Type.

And W-2 wages 20 percent. We found that most executives compensation was between 10 and 14 of total revenue and between 30 and 33 of all salaries and benefits paid these are 25th and 75 percentiles. Ie for every 100 paid to the GC the CEO was paid approximately 400 CAP also analyzed the SP 500 senior executive pay ratios by industry.

Flanagans total compensation decreased 8 in 2016 while the firms net income over the period. COO ratio the Utilities sector had the highest ratio of 30x at median while Energy had the lowest ratio of 19x at median. A companys revenue is directly affected by the amount of compensation it pays its employees or labor force.

Granted CEO compensation grew 11 million or by 86 to 145 million in 2019. Total direct compensation which includes equity 21 percent. Total cash compensation 30 percent.

CEO pay as well as senior executive pay grew at 31 and 21 respectively for the overall R3000 and SP 500 indices. By annual revenue the overall growth was primarily driven by companies in the mid-market brackets US599 billion and US10249 billion which reported total CEO compensation rises by 88 percent and 127 percent. There was a fairly even distribution in the Consistently Applied Compensation Measure CACM used by companiesbase pay 21 percent.

Some CEOs have a 1 or less cash salary and are compensated entirely with stock options or equity grants. So they make much more than 100 of revenue. Realized CEO compensation grew to 213 million in 2019 which was 26 million or 140 higher than in 2018.

Has grown exponentially since the 1970s according to the Economic Policy Institute EPI rising almost 1000 percent compared to a rise in worker salaries of roughly 11. The compound annual growth rate for median worker pay equals approximately 2 percent per year compared to 46 percent for median SP 500 CEO pay 5 percent for median SP 400 CEO pay and 77 percent for median SP 600 CEO pay. Worker pay in the period since the financial crisis.

CEO compensation is very much case specific. A CEO with a 1 million salary may also receive a 700000 bonus. Measuring the relationship between revenue and compensation figures in an accounting period using a financial analysis tool known as revenue-to-compensation or labor-to-revenue ratio can help you monitor how well your business is utilizing its human resources to.

But even some major groups pay CEOs more. Because the executive directors salary typically acts as a ceiling keeping the executive directors salary low also serves to keep other salaries low. Of course t hese percentages of budget cannot be used.

The median CEO running a company with between 10 and 25 million in revenues earned 529 of the total compensation of the median CEO leading a company with revenues of 100 to 250 million. The growth in realized CEO compensation was driven by a 195 growth in vested stock awards and a 175 growth in exercised stock options.