As with any insurance coverage that includes a deductible. In the RAND health insurance study people who had a higher deductible had a lower overall use of healthcare.

Health Insurance Deductible How Do Deductibles Work Mint

Health Insurance Deductible How Do Deductibles Work Mint

The deductibles are high because the insurance companies know you wont use their plans because you cant afford to after paying your high premiums.

Why are health insurance deductibles so high. Insurance deductibles are common to property casualty and health insurance products. As mentioned the health insurance deductible may vary from plan to plan. Though low-premium insurance options are available in the form of high-deductible health.

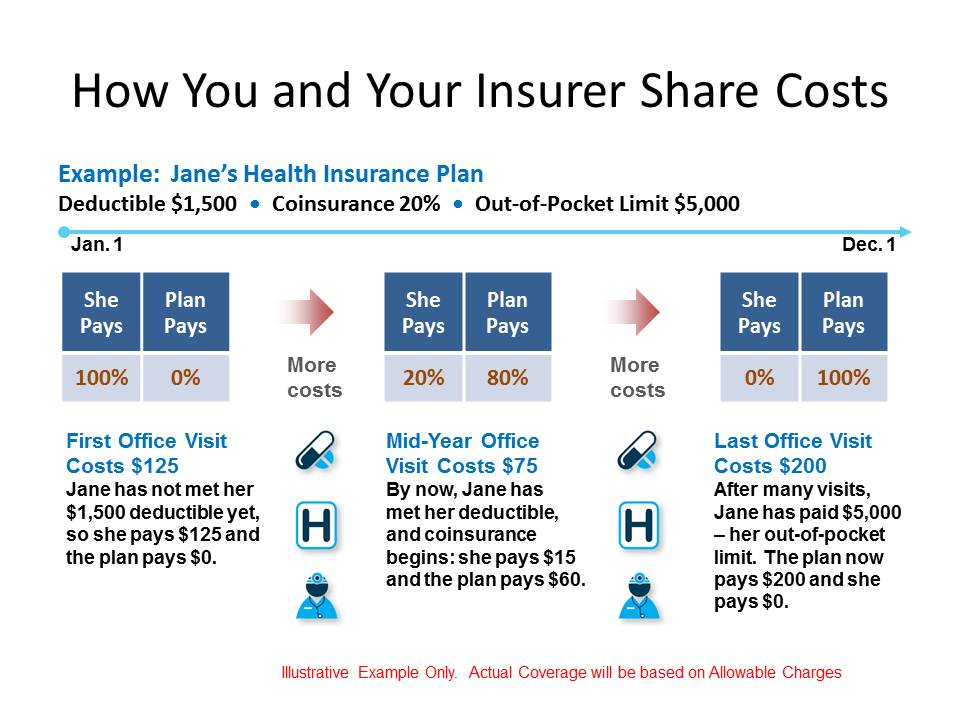

The use of coinsurance and co-payments has also created greater motivation for patients to strategically choose medical treatments. Typically when you have a health insurance plan with a low monthly premium the monthly payment youll have a higher deductible. Youre not just seeing things.

While raising deductibles can moderate premiums it also increases costs for people with an illness or who get hurt. Theyre out-of-pocket costs that you must pay before your insurance coverage kicks in. With regards to homeowners insurance a high deductible can be caused by a high value home.

High deductibles are a fact of life. These plans are referred to as zero-deductible plans. This means you wont be paying a lot for your monthly bill but if you need to use your insurance youll have to pay for medical expenses until you reach your deductible.

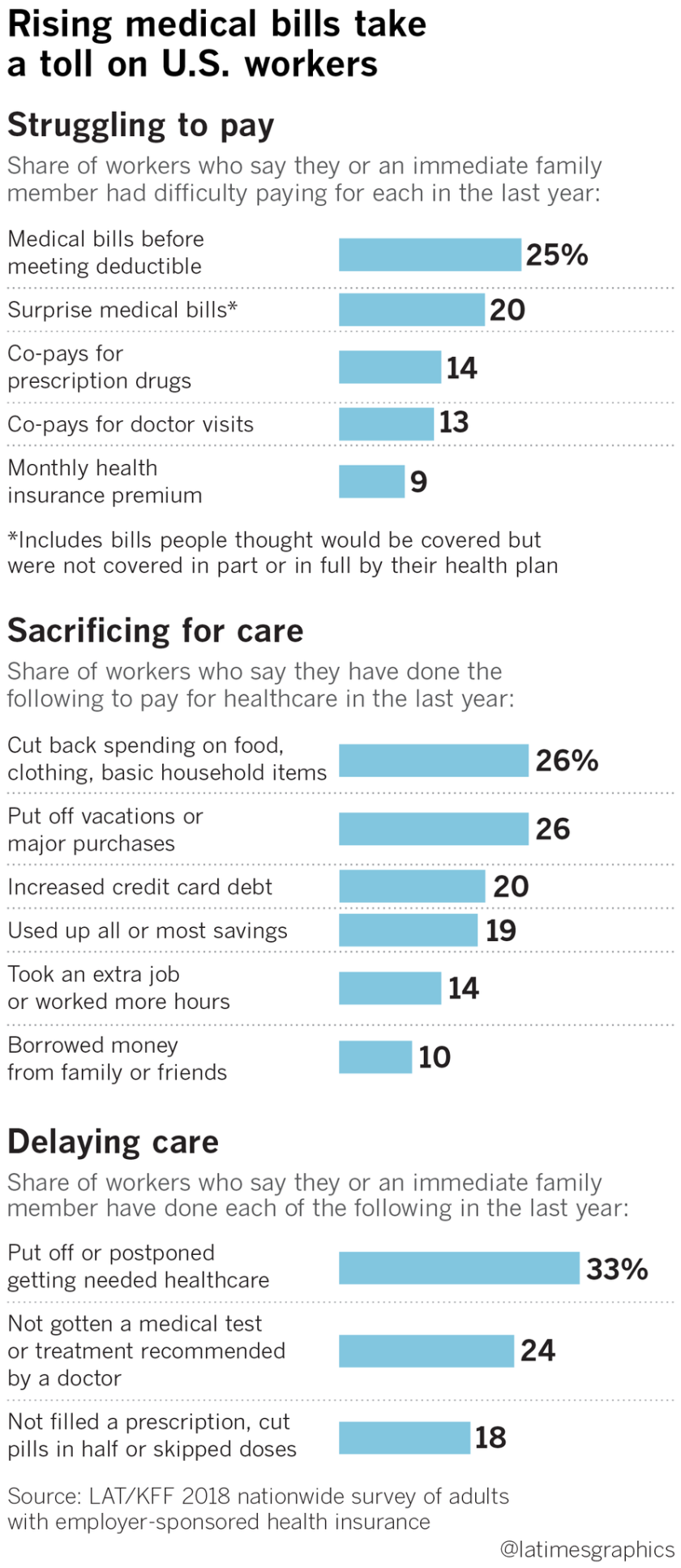

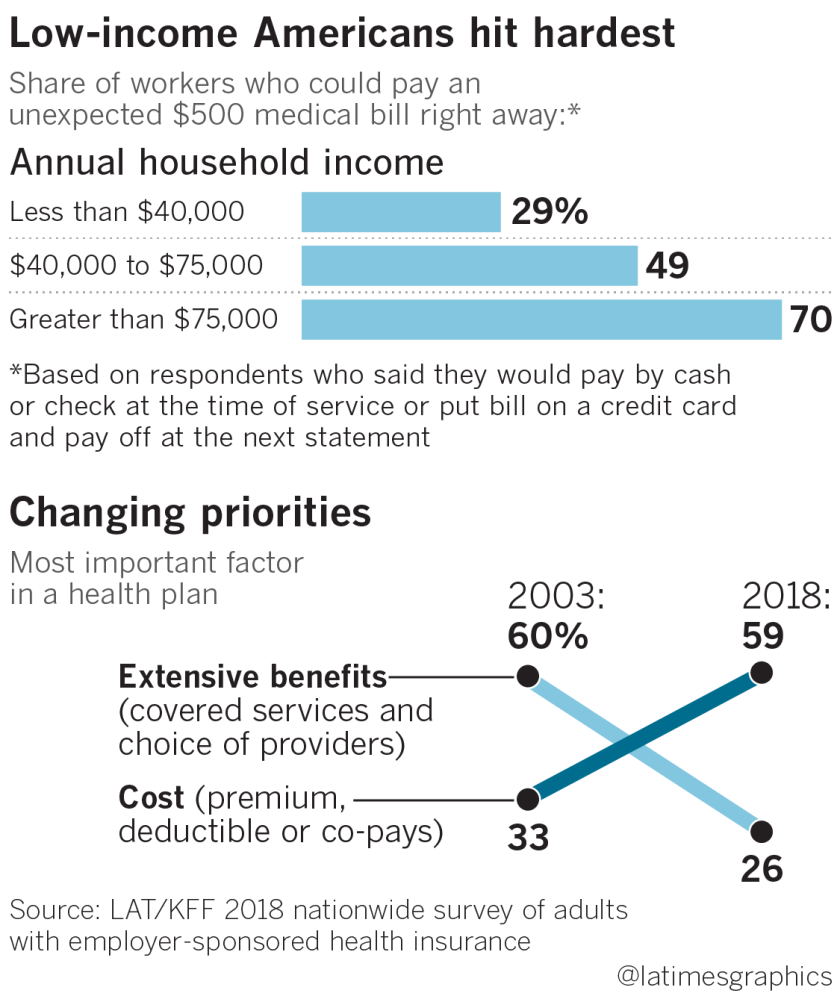

A Kaiser Family Foundation study finds that about half of all people with employer provided. Use less care because they decided not to seek care. In high-deductible plans women are more likely to delay follow-up tests after mammograms including imaging biopsies and early-stage diagnoses that could detect tumors when theyre easiest to.

Many insured workers in such plans must pay thousands more than that each year. Many workers fearful of incurring high out-of-pocket costs respond to the spot price or the up-front cost rather than considering what they are likely to spend throughout the year and whether. Field notes that many deductibles are in the range of 5000 to 6000.

One of the less obvious functions of health insurance deductibles is their ability to make consumers aware of health care costs. Why your health-care costs are so high even if youre insured Cost sharing. Everything involved in insurance and medical care is to make some people extremely wealthy.

Health savings accounts HSAs are no cure-all. Some plans typically HMOs may not have a deductible at all. The idea was that since consumers would have to pay a large chunk of their own money for medical care.

Shop around for cheaper care - perhaps wait for the doctors office to open instead of going to the emergency room. Higher Deductible Means Lower Premium The actual amounts are what separates deductibles that are low or high. Higher health insurance deductibles a sickening trend for Americans The ruthless medical math.

Moreover high-deductible plans boost companies bottom line by shifting more costs to the employee. Just a couple thoughts. Why so high.

This is because people who have a share of the cost will. At the high end of the range those costs can top 5000 a year. High-deductible plans however often come with a health savings account or HSA that is a tax-advantaged account that allows workers to save pretax dollars grow their money free of tax and.

They are becoming higher and more prevalent with each passing day. Its important to take your time to compare plans side by side since higher plan deductible may be offset by lower cost sharing or premiums and vice versa. Catastrophic and bronze plans have your highest deductibles silver is your mid level plan and gold and platinum are your lowest deductible plans.

The reason for this is carriers offer a lower premium in exchange for you taking on a larger share of the risk of healthcare expenses. High deductible health insurance plans were supposed to help consumers cut healthcare costs. The IRS currently defines a high-deductible health plan as one with a deductible of at least 1350 for an individual or 2700 for a family according to healthcaregov.

Monthly Insurance premiums are now as much as some peoples mortgage payments but with a mortgage. The lower the deductible the higher your premium. Consumers are paying more money in the form of higher premiums deductibles.

Those with high deductibles tend to have lower premiums but out-of-pocket costs that you are required to pay are. Based deductibles are becoming more common and certainly could contribute to this feeling.

Too High A Price Out Of Pocket Health Care Costs In The United States Commonwealth Fund

Too High A Price Out Of Pocket Health Care Costs In The United States Commonwealth Fund

Why Are Health Insurance Deductibles So High Kindhealth

Why Are Health Insurance Deductibles So High Kindhealth

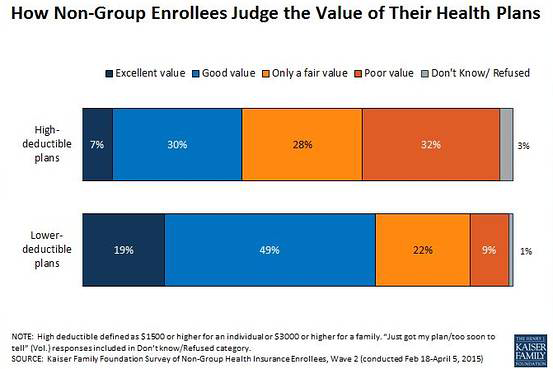

The Value Trade Off In High Deductible Health Plans Kff

The Value Trade Off In High Deductible Health Plans Kff

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

What Is An Insurance Deductible Napkin Finance

What Is An Insurance Deductible Napkin Finance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.