The Lawsuit Begins. If it isnt resolved a lawsuit is only a matter of time.

Will You Be Sued Over An Unpaid Debt Credit Com

Will You Be Sued Over An Unpaid Debt Credit Com

The complaint will explain why the collector is suing you and what it wantsusually repayment of money you owe plus interest fees and costs.

Lawsuit for unpaid debt. No consumer with credit card debt should ever ignore a creditors collection attempts related to unpaid debt. How to Sue for an Unpaid Debt Step 1. Once that passes the debt is considered time-barred That means you cant legally be sued but collectors may still try it in violation of.

The debt has been paid or excused. The automatic stay puts an immediate end to lawsuits for unpaid debts harassing creditor phone calls any active wage garnishment or wage garnishment about to start collection letters repossessions and any other collection efforts taken by debt collectors or creditors. A debt collection lawsuit begins when the collection agency files a complaint sometimes called a petition in court.

Lawsuits can be effective in high-stakes situations where the amount owed is significant. By the time an unpaid debt turns into a court summons it has already passed from the initial creditor to at least one debt collection agency. To establish that a debt is owed and is past due you should send by.

A business may sue for unpaid debt once other available options for collection have been exhausted. This article covers the basics of what to do if a creditor has filed a lawsuit against you for unpaid debt. While you must be properly.

PMs spokesperson says judgment issued in October over 535 unpaid debt is totally without merit First published on Wed 12 May 2021 0629 EDT A county court debt judgment issued against. It will cover everything from reading the complaint to choosing the right attorney. You might not be sued because your debt is too small.

If you dont show up for the court proceeding the judge automatically rules against you and will order you to. First a business would typically initiate a suit for unpaid debt by bringing claims for breach of contract negligence unfair business practices and potentially other claims. This means the debt is too old to be enforced.

In this case the statute of limitations sets the deadline at 6 years so you cant be sued for a debt based on a contract from six years ago. A debt collection defense attorney is crucial at the trial stage of an action for an unpaid debt based on breach of contract or an open account. Nevertheless it is possible to be sued for a debt especially if you fail to communicate with your creditor and miss multiple payments.

Creditors sometimes dont sue people over unpaid accounts simply because they cannot find sufficient documentation to warrant the time trouble and expense of commencing a lawsuit. If there is a judgment against you the collector or creditor no longer has to make a deal with you for debt settlement. When you respond or answer the lawsuit the debt collector will have to prove to the court that the debt is valid and that you owe the debt.

The time limit varies from state to state. In this situation and this doesnt just apply to credit card debt a creditor may file a lawsuit based on an open account andor breach of contract. If a customer has received a service or product even if he or she claims the product to be defective he or she is liable for paying or returning the product within a.

If you are sued carefully read the lawsuit and respond by any deadline. Credit card companies write off millions each year in uncollectible debt. The single most effective form of debt collection for any creditor or debt collector is the filing of a lawsuit.

Whether the summons and complaint were properly served. The time a creditor has to file suit against you is limited by law in each state. Sometimes your debt has been handled by multiple debt.

Send a demand letter to the borrower. If youre being sued over an unpaid debt you do have legal ways to defend yourself. If a lawsuit is filed you MUST respond.

If the creditor did not serve you correctly then the claim cannot go forward. If the amount of the debt is under a certain amount usually 10000 7500 or 5000. Suing Over Unpaid Debt.

Here are 8 things our lawyers look for when defending our clients in a debt collection lawsuit. Once a debtor files an answer that responds to the complaint a presiding court will typically schedule discovery which is the process by which both of the parties to the lawsuit discover or exchange information. If a lawsuit is filed against you and you do not properly respond you may wind up having a judgment against you.

In most states it is anywhere from three to six years. A statute of limitations is a law that sets a deadline on an action. If you dont respond the court will likely issue a judgment against you as requested in the lawsuit.

Ianthus Sued Over Unpaid Debt Ganjapreneur

Ianthus Sued Over Unpaid Debt Ganjapreneur

/what-happens-if-you-dont-pay-a-collection-960591-v3-5bbe02b546e0fb00510fde7e.png) What Happens If You Don T Pay A Debt Collection

What Happens If You Don T Pay A Debt Collection

What It Means To Be Sued For An Unpaid Debt In Houston

What It Means To Be Sued For An Unpaid Debt In Houston

What Happens If I M Sued For An Unpaid Debt Part 1 Defending A Case And The Statute Of Limitations Parker Law Firm

What Happens If I M Sued For An Unpaid Debt Part 1 Defending A Case And The Statute Of Limitations Parker Law Firm

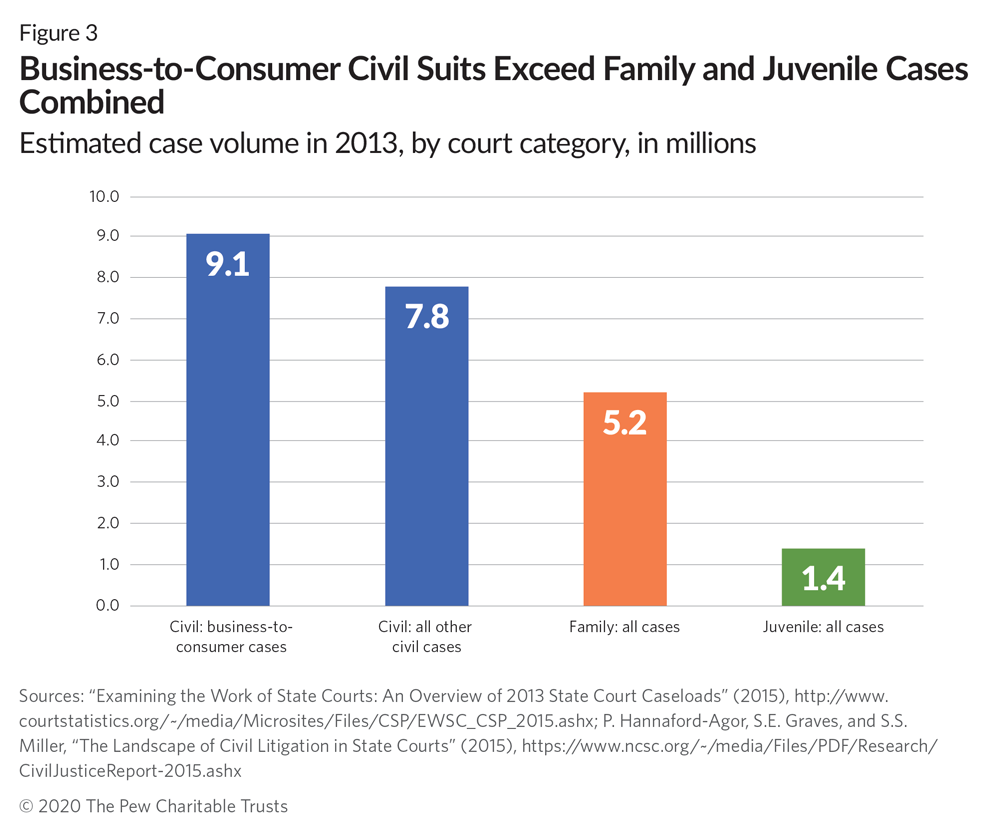

How Debt Collectors Are Transforming The Business Of State Courts The Pew Charitable Trusts

How Debt Collectors Are Transforming The Business Of State Courts The Pew Charitable Trusts

8 Possible Defenses To A Debt Collection Lawsuit The Consumer Law Group P C

8 Possible Defenses To A Debt Collection Lawsuit The Consumer Law Group P C

What Should I Do If I Ve Been Sued For Debt Findlaw

What Should I Do If I Ve Been Sued For Debt Findlaw

Settling Or Defending A Credit Card Debt When You Are Sued

Settling Or Defending A Credit Card Debt When You Are Sued

Sued For Debt Here S What To Expect Nerdwallet

Sued For Debt Here S What To Expect Nerdwallet

Ask An Attorney What Happens If You Re Sued For Unpaid Debt Panda Law Firm Peters And Associates

Ask An Attorney What Happens If You Re Sued For Unpaid Debt Panda Law Firm Peters And Associates

Can You Sue Someone For Unpaid Debt Stapler Confessions

Can You Sue Someone For Unpaid Debt Stapler Confessions

Syn If You Stop Paying Your Credit Cards Can You Get Sued

Syn If You Stop Paying Your Credit Cards Can You Get Sued

Help I Ve Been Sued By A Debt Collector Resolve

Help I Ve Been Sued By A Debt Collector Resolve

What Happens When You Get Served Papers For Debt

What Happens When You Get Served Papers For Debt

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.