An individual mandate is an incentive for everyone to get health insurance even healthy people. As of 2019 the Obamacare Individual mandate which requires you to have health insurance no longer applies at the federal level.

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

Although the fee for not having health insurance has been reduced to 0 on a federal level since 2019 some states still have an individual mandate.

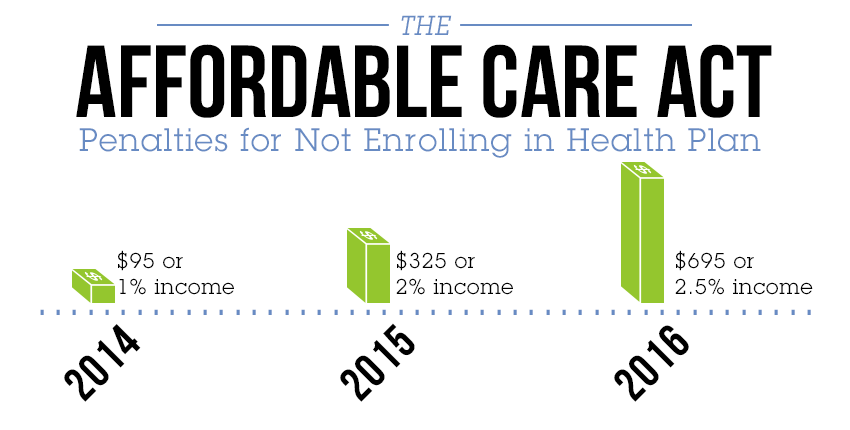

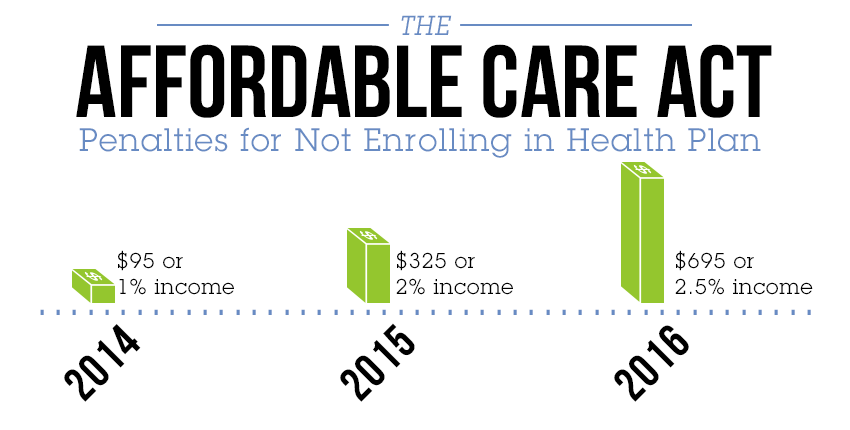

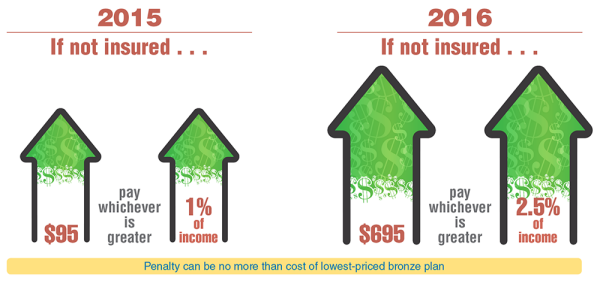

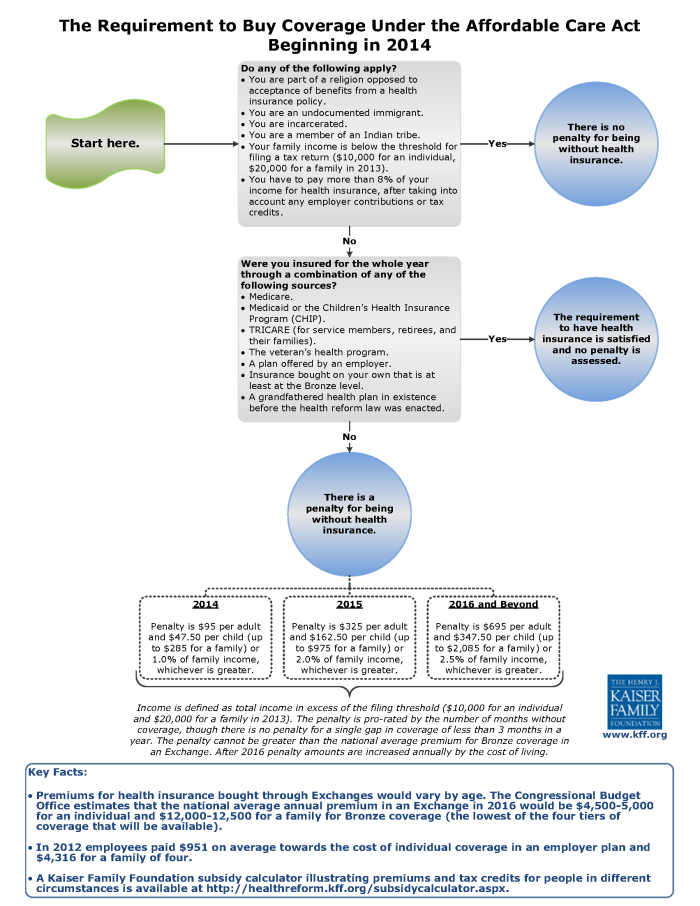

Is there an individual mandate for health insurance. The fee is officially called the Shared Responsibility Payment but is usually called the individual mandate penalty fee or fine. Here is a list of states where you have to buy health insurance for 2020. The mandate went into effect in 2014 requiring almost all Americans to maintain health insurance coverage unless theyre eligible for an exemption.

That means they dont have to have health insurance and dont have to pay the penalty fee for noncompliance. That meant there was now a larger pool of people applying for health insurance. See state-based mandates for 2021.

If you live in a state that requires you to have health coverage and you dont have coverage or an exemption. Some states still require you to have health insurance coverage to avoid a tax penalty. You may have to pay a penalty for not having health insurance if you live in one of the following.

Who was affected by the individual mandate. The individual mandate penalty applies only to adults who can afford health insurance. The rest of the Affordable Care Act and its many patient protections remain in effect.

Some states have their own individual health insurance mandate requiring you to have qualifying health coverage or pay a fee with your state taxes for the 2019 plan year. The federal government collects the penalty through your taxes when you file your federal tax return. The individual mandate itself is still in effect but there is no longer an enforcement mechanism so its essentially irrelevant.

It eliminated the penalty as of 2019 but did not eliminate the actual individual mandate itself. This means that you will no longer have to pay a fine to the federal government if you choose to go without health insurance. If according to the state affordability schedule you have no affordable options you wont be penalized.

However Trump changed all that so starting in 2019 health insurance is no longer mandatory. This requirement is commonly referred to as the laws individual mandate The law imposes a tax penalty through 2018 on those who fail to have. However there are certain groups of people who are exempt from the individual mandate.

Theres no penalty if your income is at or below 150 of the federal poverty level because there is no premium and therefore no penalty. But as of 2019 there is no longer a penalty for non-compliance with the individual mandate. From 2014 through 2018 there was a penalty assessed by the IRS on people who didnt maintain coverage and.

However 5 states and the District of Columbia have an individual mandate at the state level. Without an individual mandate the health insurance market is likely to break down due to the adverse selection problem but such a mandate can place a. So technically the law does still require most Americans to maintain health insurance coverage.

The individual mandate is a provision within the Affordable Care Act that required individuals to purchase minimum essential coverage or face a tax penalty unless they were eligible for an exemption. Youll be charged a fee when you file your 2019 state taxes. And with more healthy people getting health insurance health insurance companies could lower premiums for everyone.

January 2013 A health insurance mandate is either an employer or individual mandate to obtain private health insurance instead of or in addition to a national health insurance plan. The individual mandate is a fee for not having qualifying health coverage throughout the year. The health care reform legislation that became law in 2010 - known officially as the Affordable Care Act and also as Obamacare - requires most Americans to have a basic level of health insurance coverage.

Most people have to get health insurance under the law whether its from the marketplace your job or directly through an insurer. This article may be in need of reorganization to comply with Wikipedias layout guidelines. Health insurance coverage is no longer mandatory at the federal level as of January 1 2019.

Under President Obamas Affordable Care Act ACA the individual mandate required everyone to have health coverage. This is due to legislation that was enacted in late 2017.

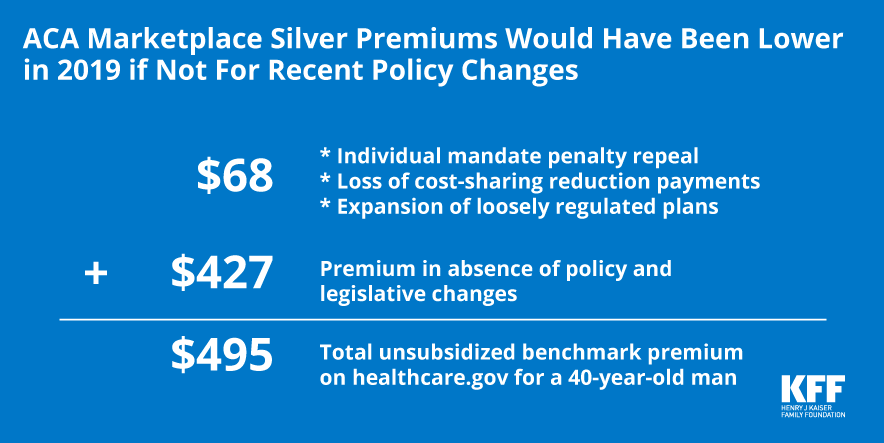

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

![]() Obamacare Individual Mandate Millennium Medical Solutions Inc

Obamacare Individual Mandate Millennium Medical Solutions Inc

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

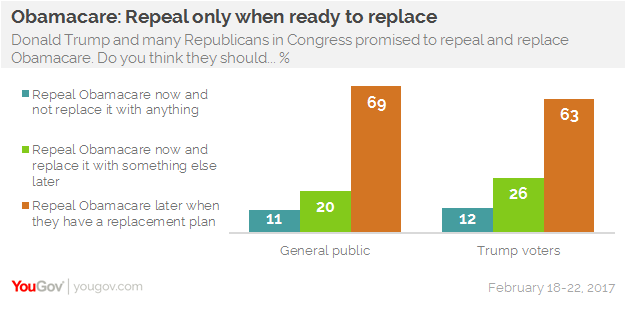

The Public Wants Obamacare Minus The Individual Mandate Yougov

The Public Wants Obamacare Minus The Individual Mandate Yougov

Study State Level Individual Mandates Would Reduce Number Of Uninsured By Nearly 4 Million In 2019 Health Plan Premiums Would Fall 12 Percent Commonwealth Fund

Study State Level Individual Mandates Would Reduce Number Of Uninsured By Nearly 4 Million In 2019 Health Plan Premiums Would Fall 12 Percent Commonwealth Fund

What Is The Individual Mandate For Health Care Reform Turbotax Tax Tips Videos

What Is The Individual Mandate For Health Care Reform Turbotax Tax Tips Videos

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

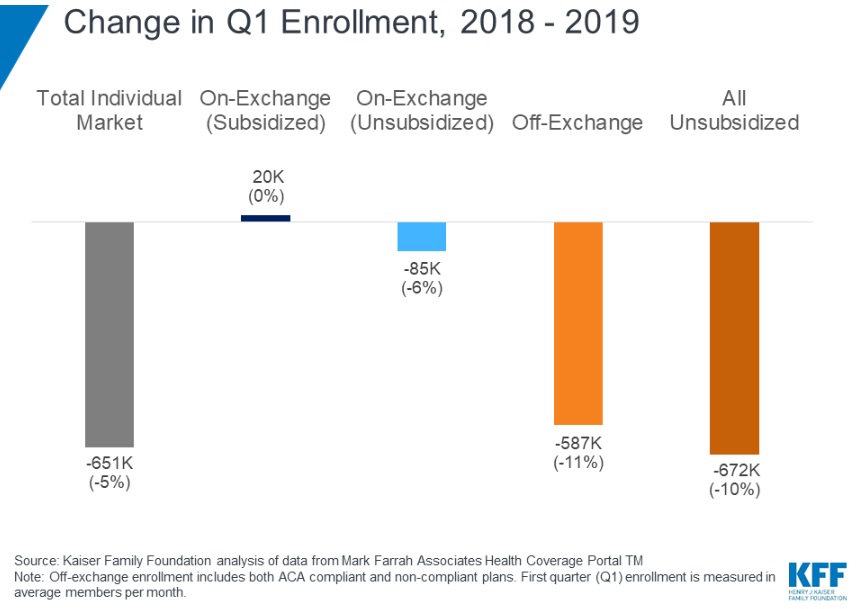

Individual Mandate Repeal Leads To Small Drop In Enrollment Benefitspro

Individual Mandate Repeal Leads To Small Drop In Enrollment Benefitspro

/cdn.vox-cdn.com/uploads/chorus_asset/file/9679165/8940_figure_11.png) Republicans Have Finally Repealed A Crucial Piece Of Obamacare Vox

Republicans Have Finally Repealed A Crucial Piece Of Obamacare Vox

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.